Uncompensated care can cost large health systems billions of dollars annually, making outstanding balances one of their biggest costs.

Propensity-to-pay tools help organizations target unpaid accounts by using artificial intelligence (AI) to leverage external and internal financial and socioeconomic data and identify the likelihood that patients in a population will pay their balances (propensity to pay).

With propensity-to-pay insight, financial teams can focus their efforts on patients most likely to pay, and connect patients who are unable to pay with charity care or government assistance. Both health systems and patients benefit, as patients can avoid bad debt and organizations receive compensation for care they’ve delivered.

Download

Download

What’s one action a health system can take to significantly improve its bottom line? Collect unpaid balances from patients for healthcare services (uncompensated care); by doing this, systems stand to curb one of their highest costs.

This article will explain how artificial intelligence (AI) powers solutions that help organizations reduce their rates of uncompensated care and improve the patient experience. Known as propensity-to-pay tools, these solutions integrate with workflow tools to identify the likelihood that a patient will pay a balance, and then assign appropriate ways for finance teams to reach out to the patient.

Uncompensated care includes bad debt (balances that can’t be recovered) and charity care (healthcare provided for free or at reduced costs to low-income patients) for self-pay patients. Self-pay patients either don’t have health insurance or have a balance due that their insurance doesn’t cover (due to coinsurance, deductibles, or services their policy doesn’t cover).

For health systems, the economic implications of uncompensated care are significant. For example, one regional health system wrote off $350 million to bad debt in 2016. In 2015, a larger health system reported bad debt of over $3 billion. Healthcare consumers are also feeling the impact of high-deductible plans and large out-of-pocket expenses: medical debt is the number one cause of bankruptcy in the U.S.

As high-deductible health plans are increasingly common, and insurance plans allow people to sign up for them without determining if the consumer can afford the out-of-pocket costs, health systems are experiencing considerable growth of uncompensated care.

According to the Kaiser Family Foundation and Health Research & Education Trust’s 2015 Summary of Findings, the proportion of U.S. workers with high-deductible insurance plans grew from 13 percent in 2010 to 24 percent 2015. During that same period, the patient’s annual financial responsibility rose from $2,713 to $4,955. This trend in high-deductible plans and uncompensated care will continue, and may even become more relevant under at-risk reimbursement models, as organizations take on more financial risk.

In addition to the proliferation of high-deductible health plans, another factor behind the massive unpaid balances in healthcare today is that organizations don’t have effective and efficient ways to collect on these debts. Because high-deductible plans place all payment risk on the patient and the health system, organizations must navigate each individual insurance plan, balance, and allowable charges, and then collect on the balance.

Health systems often have departments of dozens to hundreds of team members dedicated to collecting patient balances, or getting patients charity care. But, given the complexity of collecting (described above), these departments can only do so much; their resources are relatively small compared to the balances they have to collect. For example, large organizations may have 250,000 patient balances to collect at any given time and only about 50 people doing the collections work.

The collection process often involves calls and letters to anyone with an outstanding balance, so that people who are likely to pay and those unlikely or unable to pay receive the same treatment. This one-size-fits-all approach can create a bad experience for patients who intend to pay in full, as they’re unnecessarily pursued, while futilely expending resources on patients who are unlikely or unable to pay and would be better served by charity care.

There’s a lot of nuance to an unpaid bill that health systems don’t have a way of understanding (e.g., the patient has a good income, but can’t pay a huge sum out of pocket at once, versus a patient with a low income who’s a candidate for charity care). To effectively reduce uncompensated care, organizations need to be thoughtful about who they contact about collection and how they reach out.

Current EMRs and billing systems employ overly simplistic methods that use generic modes of prioritization, such as sorting collections by highest to lowest balance, oldest to newest balance, or alphabetically by patient name. This blind approach leads to lost revenue and inappropriate treatment of patient balances.

Even experts in healthcare billing are vulnerable to bad debt. For example, a revenue cycle management consultant on contract at a large integrated health system missed a payment when a bill went to the wrong address and ended up in collections. This billing professional had the desire and means to pay, but health systems don’t have an effective way to determine propensity to pay throughout their populations. If this individual with a high degree of understanding of the billing process can fall through the cracks, it can happen to anyone.

To reduce rates of uncompensated care and improve the patient experience, health systems must have a better way of understanding patients’ likelihood to pay and effective ways to reach out to them.

An AI-driven approach to propensity to pay generates a comprehensive view of a patient’s likelihood to pay by combining external (e.g., census, income, and poverty levels) and internal data (e.g., patient payment performance data that’s unique to that health system and its population). By merging millions of records, using algorithms to derive a patient’s propensity-to-pay score, and seamlessly integrating that knowledge into the organizational workflow, AI gives health systems a pragmatic approach to collecting from patients and driving down uncompensated care.

By understanding propensity to pay, health systems can determine which patients need reminders, which need financial assistance, and whether payment patterns are likely to change over time and after particular events. Organizations can then dedicate resources to the bills most likely to be paid, rather than pursuing balances that are unlikely to be resolved.

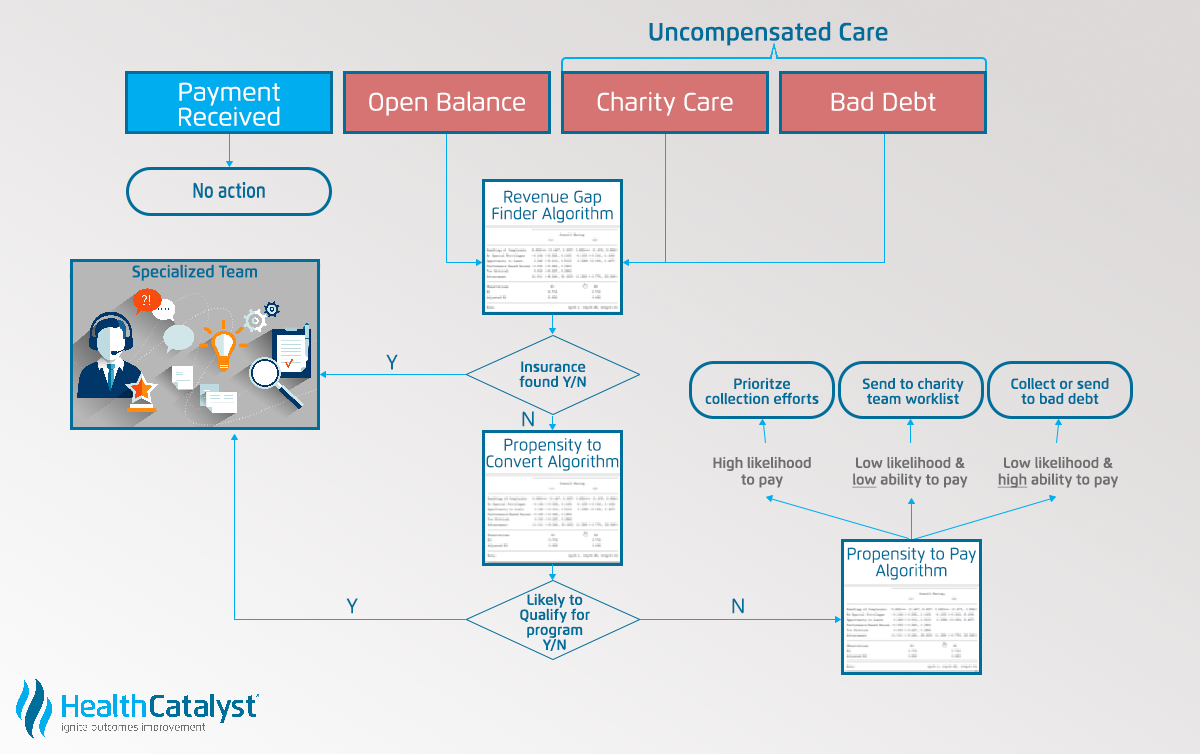

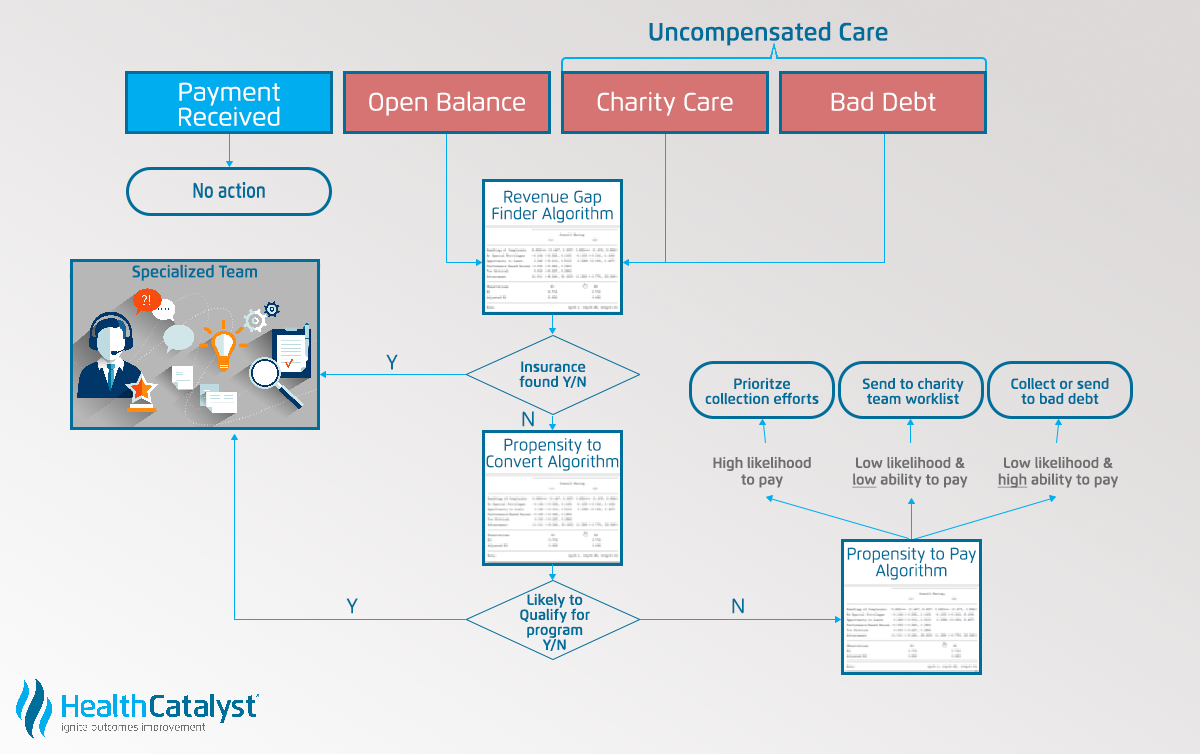

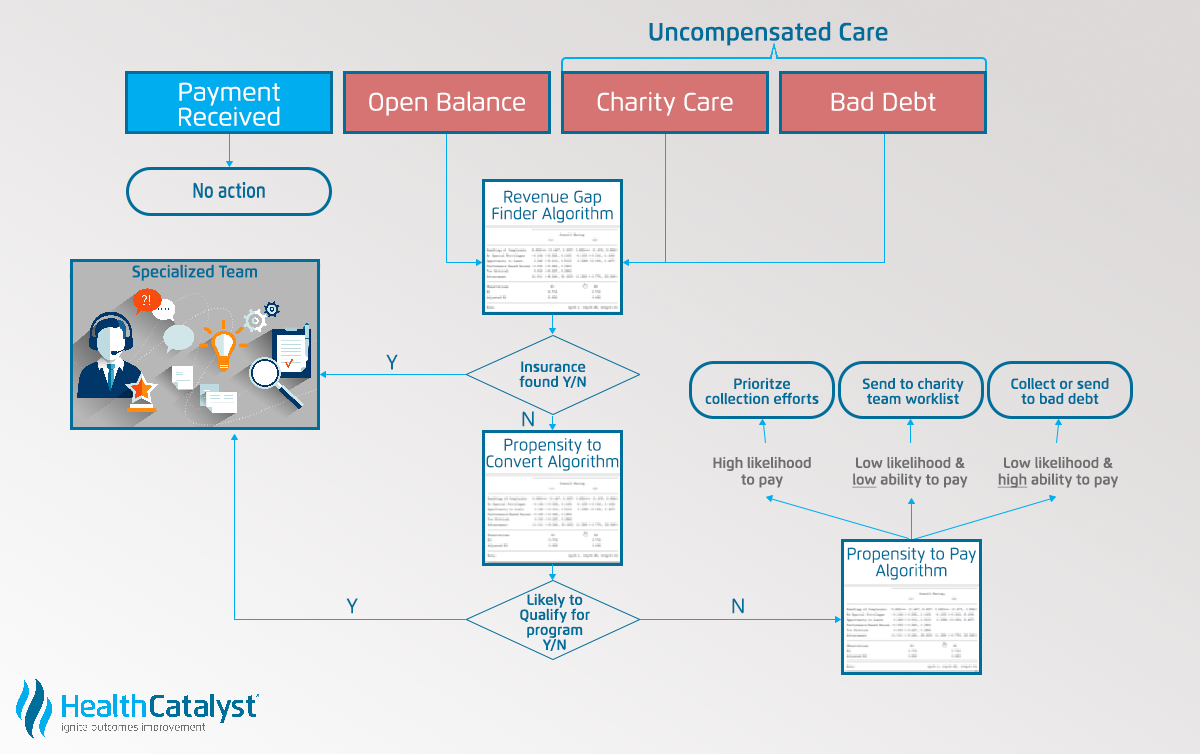

Figure 1 shows how the propensity-to-pay program uses algorithms to designate a patient’s propensity to pay and align that patient with an appropriate intervention:

AI-driven propensity to pay performs four key actions:

An algorithm uses several factors to determine a patient’s propensity to pay: historical payment and demographic information, external socioeconomic data, size of balance, patient age (older individuals are more likely to pay), and many more data points. The propensity-to-pay program then designates corresponding interventions. The integrated propensity-to-pay identification step occurs in the EMR workflow to enable finance departments to better allocate staff and resources and follow intervention recommendations.

Patients with lower propensity to pay will receive automated reminders or counseling for financial assistance. Billing staff sees which accounts have the lowest propensity to pay and can write them off to bad debt (preserving resources for more promising accounts). For example, a patient with a low propensity to pay, a high balance, and a history of charity care, probably won’t be able to able to pay. Instead of letting this patient continue to bad debt, the finance team can help immediately by shifting the patient to charity care or government funding.

Patients with medium propensity to pay will receive interventions targeted to their situations (e.g., a reminder phone call, a recommendation for charity care, etc.). The system further divides medium propensity-to-pay patients into medium-low and medium-high categories, for which developers are currently testing interventions and methods to reach out (an example of the continuous improvement that AI enables). For instance, these patients may respond best to an automated payment plan and email reminders.

Patients with high propensity to pay will receive no initial intervention. If these patients don’t pay after a set time frame, they receive a phone call or other targeted intervention (e.g., email or text reminders). If patients with high propensity to pay miss a payment, staff can reach out to help the patients avoid bad debt.

The propensity-to-pay analytics engine works smoothly in the background of the EMR and delivers the categorized outstanding accounts directly to the billing team’s native workflows.

As high-deductible health plans become increasingly common and financial risk continues to shift to patients and health systems, organizations must have way to curb growing amounts of uncompensated care. AI-powered propensity-to-pay tools are an effective solution because they combine internal and external patient data, giving finance departments a comprehensive picture of patient’s likelihood to pay. These predictive models also integrate directly into workflows, giving billing departments immediate access to propensity to pay among patient populations and recommended interventions.

With an intelligent, analytics-driven propensity-to-pay approach, health systems will lose less money on uncompensated care, patients will avoid unnecessary bad debt collection, and those in financial need will get timely help.

Would you like to learn more about this topic? Here are some articles we suggest: