High inflation, record-low unemployment, a divided Congress, a changing competitive landscape, and the end of the COVID-19 Public Health Emergency are converging to make 2023 a pivotal year in the industry. Trends in ten key areas will affect the way healthcare leaders make business decisions.

Download

Download

In another pivotal year for the industry, 2023 healthcare trends present a complex landscape as new dynamics emerge, and existing challenges evolve. Leaders must understand and prepare for the year’s important market and policy factors to ensure quality care, stable workforces, and financial viability.

Significant factors impacting healthcare and the economy in 2023 include high inflation, record-low unemployment, a divided Congress, and the end of the COVID-19 public health emergency. Health leaders need to watch the following trend areas:

One pressing 2023 healthcare trend is that employers, especially healthcare leaders, face a challenging operating environment in 2023. Overall, unemployment rates have remained low, supporting an employee market. As of February 2023, 3.4% of Americans were unemployed, the lowest number in 54 years.

Meanwhile, a trend of workers switching industries created significant challenges for employers. According to McKinsey, almost 50% of employees moved to a different sector. In healthcare, 54% left the industry.

Clinicians cite poor emotional health and burnout as reasons for leaving their fields. According to a survey from the American Nursing Foundation, 64% of nurses feel stressed, and 54% feel exhausted. Medscape reports that 53% of clinicians are burned out, and 23% are depressed. The work for health leaders is clear: pay attention to workforce needs and concerns and build better environments accordingly.

Another 2023 healthcare trend making the headlines is that public policy has put a focus on health-related privacy in 2023. Notably, the Dobbs v. Jackson Women’s Health Organization decision to reverse Roe v. Wade gave abortion decision-making back to the state level.

As a result, some state enforcement agencies and police departments are starting to track women seeking abortions or other reproductive healthcare out of state. As these agencies use tools like social media to gather information, the Office of Civil Rights and Health & Human Services recommends HIPAA compliance with information requests, including online tracking of patients. In this environment, healthcare organizations should first make sure that they comply with HIPAA and EMTALA, regardless of state law developments. After meeting those compliance obligations, healthcare organizations should follow developments in their states to see if there are further steps they need to take to ensure the proper protection and disclosure of health information.

Healthcare leaders must consider whether the 2023 economic environment represents a new normal. In 2023, health systems don’t appear to be returning to pre-pandemic finances. From October 2020 to January 2023, major health systems saw noteworthy dips in operating margin indices (Figure 1).

Figure 1: Health system operating margin index drops from October 2020 through January 2023, Kaufman Hall.

Costs drive these negative margins, and with inflation projected to increase, healthcare leaders can’t expect a break anytime soon. McKinsey estimates that healthcare could add an extra 143% in inflation-associated costs before 2030. Forty-two percent of healthcare CEOs project that they have less than 10 years to remain financially viable under their current business models.

The Biden administration is primarily focused on supporting patients and innovation in ways that aren’t politically controversial. For example, the Cancer Moon Shot addresses screening gaps, environmental exposure, research funding, and patient and caregiver support. Other initiatives include clinical trial networks, new systems to integrate data, and programs to reduce smoking and lower prescription drug costs. Additional work focuses on improved support for veterans, tackling the mental health and opioid crises, and addressing fentanyl trafficking.

With so many positive aspects in the Biden administration's healthcare agenda, a politically fraught environment will still determine if these initiatives succeed. It remains to be seen what will get funded and which issues will be addressed.

The Republican Healthy Future Task Force focuses on empowering small businesses to offer more health plan choices, emphasizing more flexible options and enhancements to HSAs. The task force believes that small businesses should be permitted to join association health plans to increase their market power.

Additionally, the Republican healthcare agenda supports the price transparency rules and promotes transparency initiatives, such as the advanced explanations of benefits, which lets patients know ahead of time how much their care is likely to cost.

Like the Biden healthcare agenda, leaders don’t yet know if there’s enough bipartisan consensus to move these efforts forward.

Another 2023 healthcare trend the industry is facing is patient disengagement. While organizations often claim they’re committed to population health and patient engagement, real progress remains hard to quantify. Research shows trust dropping among consumers, with as many as 80% of patients reporting not telling the truth to providers or holding back appropriate information.

Winning back patient trust needs to be a priority among healthcare leaders in 2023, especially with non-traditional care settings emerging with more of a consumer mindset. Bain Capital estimates that by 2030, 30% of primary care will be delivered by nontraditional providers. As entities such as Walmart and Amazon enter the healthcare space focusing on patient expectations and needs, health systems must re-evaluate their approach.

The move to value-based care (VBC) has occurred more slowly than the industry predicted. Most organizations today are straddling VBC and fee-for-service (FFS). With VBC’s slow progress, health systems likely need to remain in both worlds. To move closer to VBC, organizations need to be faster to adopt mechanisms to support physician accountability for cost and quality and full-capitation risk.

Since January 1, 2021, hospitals have had to make their standard charges for items and services public. These include gross, discounted cash prices, payer-specific negotiated charges, and de-identified minimum and maximum negotiated charges.

In 2023, Congress and the administration will prioritize price transparency enforcement. CMS has said it will take “aggressive additional steps” to identify hospitals lacking required pricing information on their websites. Health systems that haven’t yet complied should plan to do so.

Healthcare needs to improve financially and in managing its workforce. These challenges come amid high inflation, the ongoing move to VBC, and the new competitive landscape of non-traditional providers.

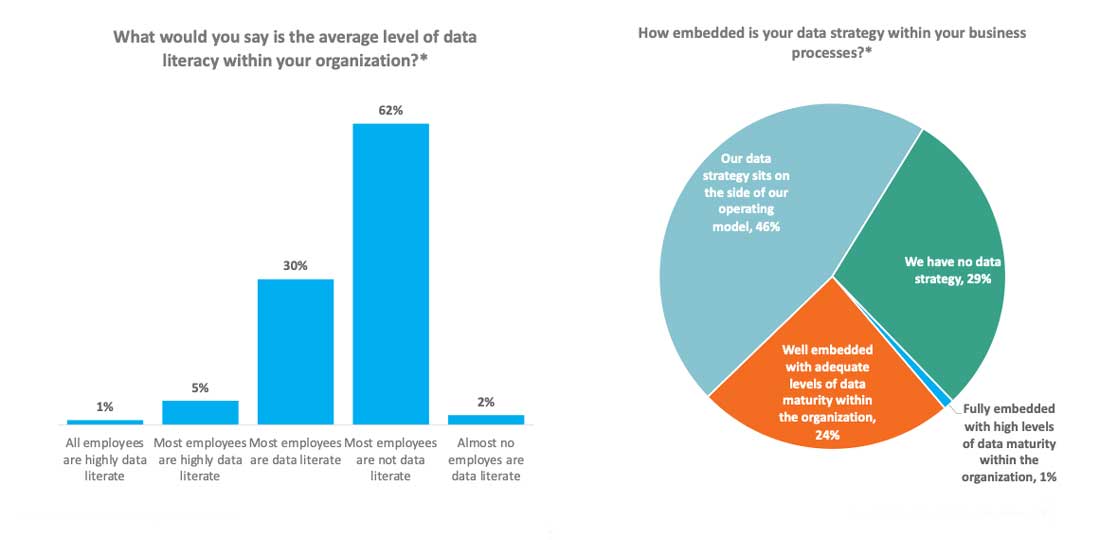

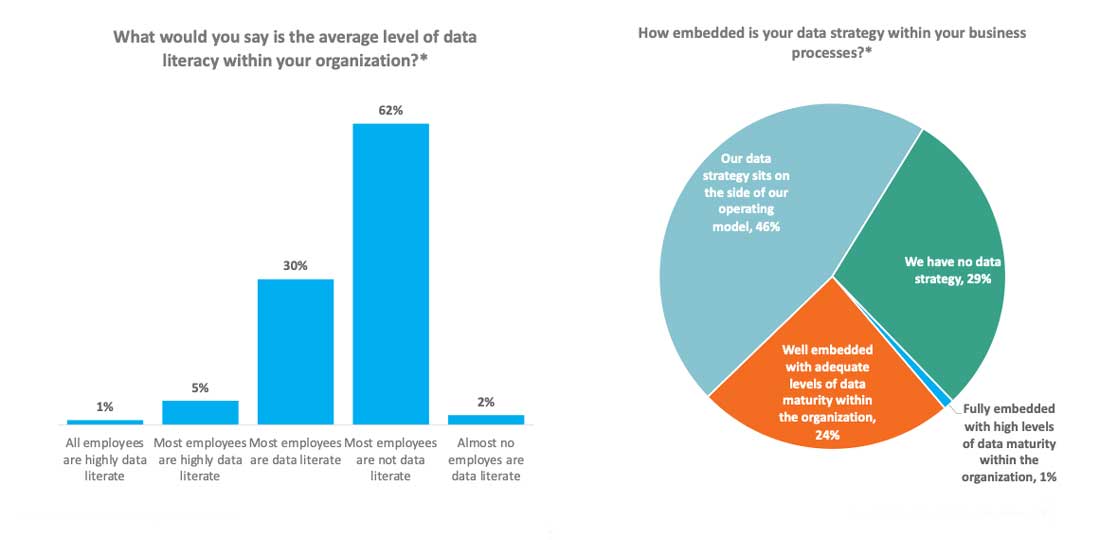

A critical factor in this fraught environment is data strategy and literacy. Unfortunately, 62% of organizations say their employees aren’t data literate. Furthermore, 46% of organizations haven’t integrated with business and data strategies (Figure 2). In 2023, organizations must ask themselves how to improve their analytics maturity—likely as a means of survival.

Figure 2: Rates of data literacy and data and business strategy alignment, Carruthers and Jackson.

The Biden Administration intends to end the COVID-19 Public Health Emergency on May 11, 2023. Its conclusion means a wind-down of federal support for Medicaid programs but a continuation of some waivers.

HHS has extended several telehealth flexibilities in the 2023 Medicare Physician Fee Schedule Final Rule for 151 days following the end of the PHE.Flexibilities include waiving originating site restrictions, allowing audio-only coverage, and expanding the list of telehealth practitioners.FDA’s emergency use authorizations for tests, vaccines, and treatments for COVID-19 will continue, as will acute hospital care at home waiver through December 31, 2024. Waivers that may be sunsetting include certain Medicare and Medicaid telehealth flexibilities, such as waiver of copayments and deductibles, virtual direct supervision, and HIPAA enforcement flexibility. Health systems must adjust to these changes in federal support as they move into the post-emergency environment.

Significant 2023 healthcare trends cover a range of industry and nationwide concerns, from inflation to worker satisfaction. While there’s no single success roadmap with these varied and complex challenges, ongoing awareness of factors impacting healthcare will help leaders make effective and sustainable decisions.

Would you like to learn more about this topic? Here are some articles we suggest: