A hot topic in healthcare right now, especially in the medical coding world is the Hierarchical Condition Category (HCC) risk adjustment model and how accurate coding affects healthcare organizations’ reimbursement.

With almost one third of Medicare beneficiaries enrolled in Medicare Advantage plans, it’s more important than ever for healthcare organizations to pay attention to this model and make sure physicians are coding diagnoses appropriately to ensure fair compensation. This article walks through basics of the risk adjustment model, why coding accuracy is so important, and five action items for interdisciplinary work groups to take. They include:

1. Having an accurate problem list.

2. Ensuring patients are seen in each calendar year.

3. Improving decision support and EMR optimization.

4. Widespread education and communication.

5. Tracking performance and identifying opportunities.

Download

Download

As enrollment in Medicare Advantage plans increases, healthcare organizations need to be able to anticipate future healthcare financial resources and predict appropriate reimbursement for physicians. The Hierarchical Condition Category (HCC) risk adjustment model is used by CMS to estimate predicted costs for Medicare Advantage beneficiaries, and the results directly impact the reimbursement healthcare organizations receive. The HCC risk adjustment model was originally implemented in 2004, but is becoming more prevalent as value-based payment models gain popularity.

The HCC model assigns a Risk Adjustment Factor (RAF) to each Medicare patient as measurement of probable costs, which is then used to adjust capitation payments for patients enrolled in Medicare Advantage plans. According to the American Academy of Family Physicians, “hierarchical condition category coding helps communicate patient complexity and paint a picture of the whole patient,” helping to appropriately measure quality and cost performance. Consequently, accurate HCC coding and risk adjustment can have a significant impact on healthcare organizations’ financial viability and care delivery.

CMS requires that all qualifying conditions be identified each year by provider organizations. Documentation linked to a non-specific diagnosis, as well as incomplete documentation, negatively affects reimbursement. Healthcare organizations that optimize their EMR, data, analtyics, and education can enable better documentation of care for patients with chronic diseases, leading to more accurate HCC risk adjustment coding, and more appropriate compensation for quality care.

The number of Medicare Advantage beneficiaries has continued to rise over the past ten years, with roughly one-in-three Medicare beneficiaries now enrolled in a Medicare Advantage plan. As with starting any new initiative, HCC coding is not intuitive, but accurate HCC coding is necessary for healthcare organizations in order to receive fair compensation. Below are a few highlights to know about the CMS HCC model complexities and risk adjustment use:

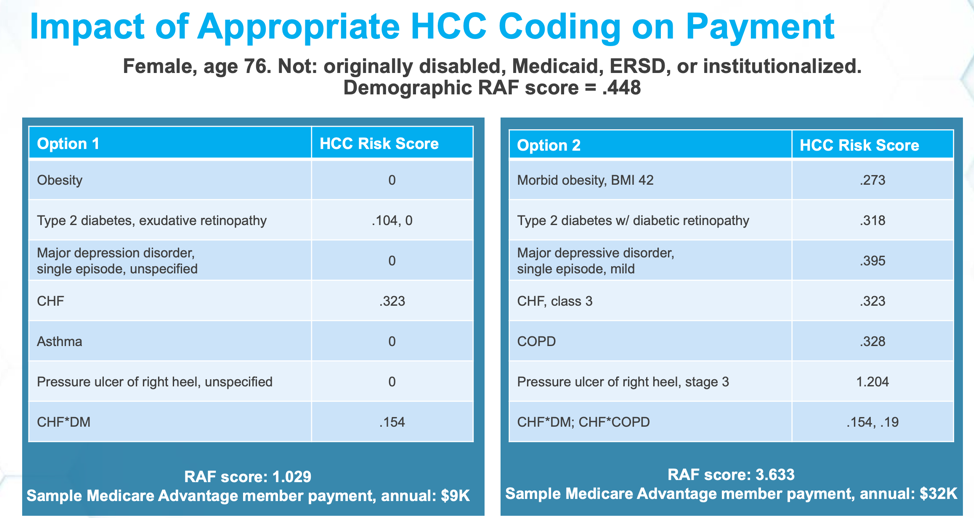

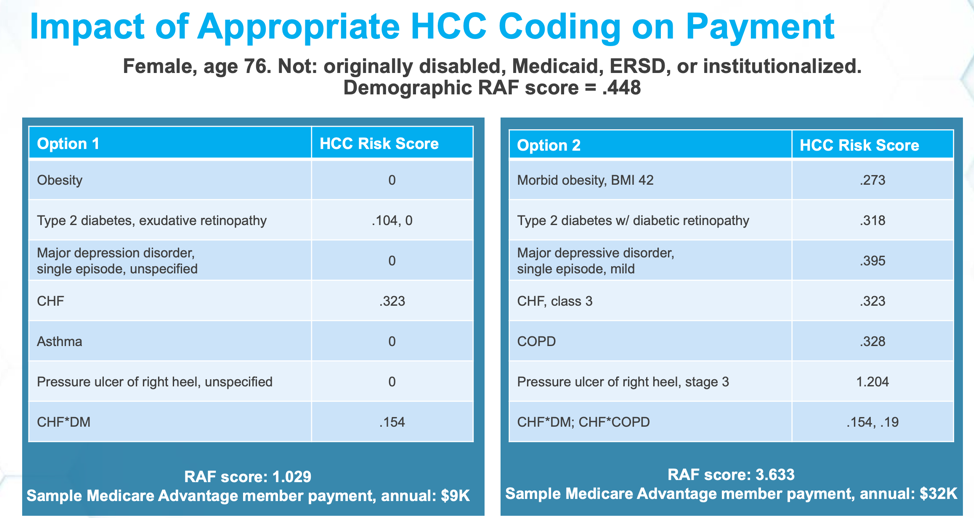

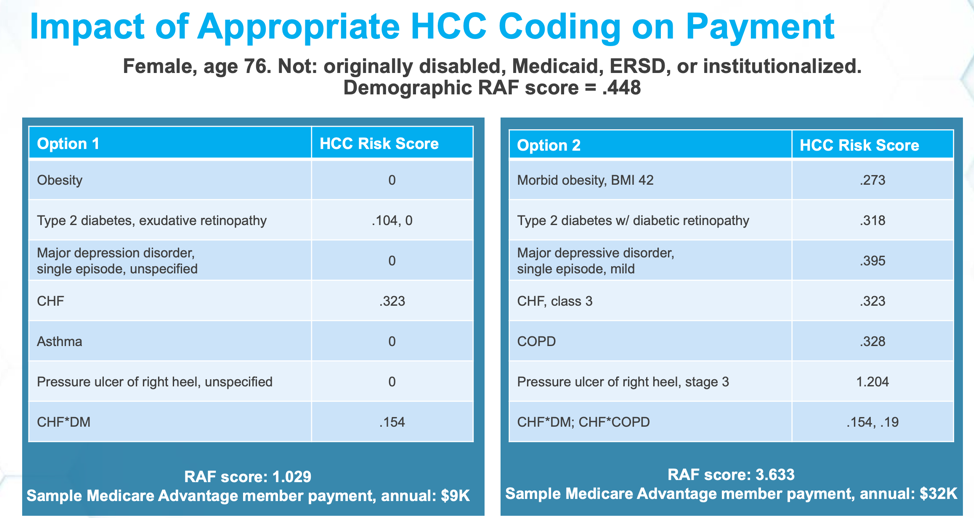

Even though the payment model is not intuitive, an organization’s ability to perform well within this model should increase over time. For example, in Figure 1 below, the table shows sample patient data from a 76-year-old female patient with an RAF score of .448. The two options show how different diagnoses change the patient’s risk score, and, as a result, the annual member payment.

In option one, the patient shows a diagnosis of obesity, which has an HCC Risk Score of zero. In option two, the patient shows a diagnosis of morbid obesity with a BMI of 42 and an HCC Risk Score of .273. Similarly, option one shows a diagnosis of asthma and an HCC Risk Score of zero. Option two shows a diagnosis of COPD and a risk score of .328. When a patient has a diagnosis of major depression, if left uncategorized, the diagnosis adds no value. If any category is chosen, such as “single episode” in the case of option two below, this adds a risk score of .395. The two different options show a patient of similar complexity but varying diagnoses, which results in vastly different annual member payments. Option one showed a total RAF score 1.029 and an annual Medical Advantage member payment of $9,000; Option two showed a RAF score of 3.633 and a Medicare Advantage member payment of $32,000 annually. While physicians should not change their diagnoses, it is important to code accurately and take credit, where deserved, for serving a complex population.

The example above provides a compelling rationale for organizations to improve their HCC coding accuracy. However, the first step is obtaining accurate data about Medicare populations before trying to make improvements in this space. It may also be beneficial to form a workgroup that is responsible for improving the accuracy of documentation and HCC coding. This workgroup could include members of the analytics team, Accountable Care Organization (ACO) team, clinicians, clinic managers, operations, and medical coders.

Forming the workgroup can help oversee the following five key action items necessary for improving HCC coding accuracy:

For organizations that are looking to embark on an effort to improve their HCC coding accuracy and risk adjustment, below are four valuable lessons learned:

Although HCC coding accuracy and risk adjustment requires changes to the way healthcare organizations are documenting and coding chronic conditions, doing so can help the organization capture more complete diagnoses, resulting in higher and more appropriate reimbursement and improved care delivery for complex patient populations.

With increasing Medicare Advantage numbers, healthcare organizations need to improve coding accuracy to remain financially viable. Creating a workgroup that’s responsible for key action items is crucial to the success of this initiative. They can help ensure the organization has an accurate problem list, chronically ill patients are seen once per calendar year, improve decision-support and EMR optimization, educate clinicians and staff, and track performance of the initiatives to share with stakeholders. They can then look for further opportunities for improvement. If healthcare organizations appropriately document the complexity of their patients, they are eligible for greater CMS revenue that can then be reinvested to better meet the needs of their patient population.

Would you like to learn more about this topic? Here are some articles we suggest:

Would you like to use or share these concepts? Download this presentation highlighting the key main points.