As enterprisewide analytics demands grow across healthcare, health systems that rely on EHRs from major vendors are hitting limitations in their analytics capabilities. EHR vendors have responded with custom and point-solution tools, but these tend to generate more complications (e.g., multiple data stores and disjointed solutions) than analytics interoperability.

To get value out of existing EHRs while also evolving towards more mature analytics, health systems must partner with an analytics vendor that provides an enterprise data management and analytics platform as well as deep improvement implementation experience. Vendor tools and expertise will help organizations leverage their EHRs to meet population health management and value-based payment goals, as well as pursue some of today’s top healthcare strategic goals:

1. Growth.

2. Innovation.

3. Digitization.

An EHR system from a major vendor isn’t designed to meet the increasingly broad and complex enterprisewide analytics demands in healthcare today. Virtually all health systems that have invested heavily in these EHRs already have hit limitations around accessing the data they need for a comprehensive understanding of their patient populations and running advanced analytics to meet population health management (PHM) and value-based payment (VBP) goals.

In addition to implementing fee-for-value (FFV) business arrangements, healthcare organizations are also rapidly pursuing these goals:

The modern healthcare enterprise understands that rapidly achieving these transformative strategies is paramount to the short-term success and longer-term viability of the organization. However, organizations (in particular, IT and analytics leadership) have struggled to define a holistic data management and technical strategy for dealing with these sea-change transformations. IT and analytics teams are falling behind business and clinical demands, often forcing the business to adopt and implement point solutions from myriad vendors. Unfortunately, a point-solution strategy further compounds the organization’s data challenges and significantly increases cost.

Like many other IT vendors (e.g., enterprise resource planning, revenue cycle, budgeting, staff scheduling, project management office, marketing, etc.) that have added point-solution reporting and analytics capabilities to their products, EHR vendors have joined the fray of building analytics infrastructure and tools around their core product offerings. With Meaningful Use incentives dried up, EHR vendors are rushing to build new revenue streams and are predominantly focusing on aggregating EHR and claims data and providing analytics tools to support VBP arrangements.

Healthcare organizations have spent hundreds of millions of dollars implementing EHR systems within their organization; yet, the industry recognizes that most EHR implementations are not living up to their original expectations. In fact, physician dissatisfaction with EHRs is at an all-time high and often cited as a key contributor to physician burnout.

Given the significant investments in procuring and implementing EHR technology, IT leaders are feeling pressure to extract greater value from their EHR vendors. And, true to form, the EHR vendors are marketing their point-solution analytics capabilities as the answer to their clients’ data management and analytics needs. It’s understandable that a number of healthcare IT leaders are buying into the belief that their EHR vendor can indeed satisfy their data management, reporting, and analytic needs.

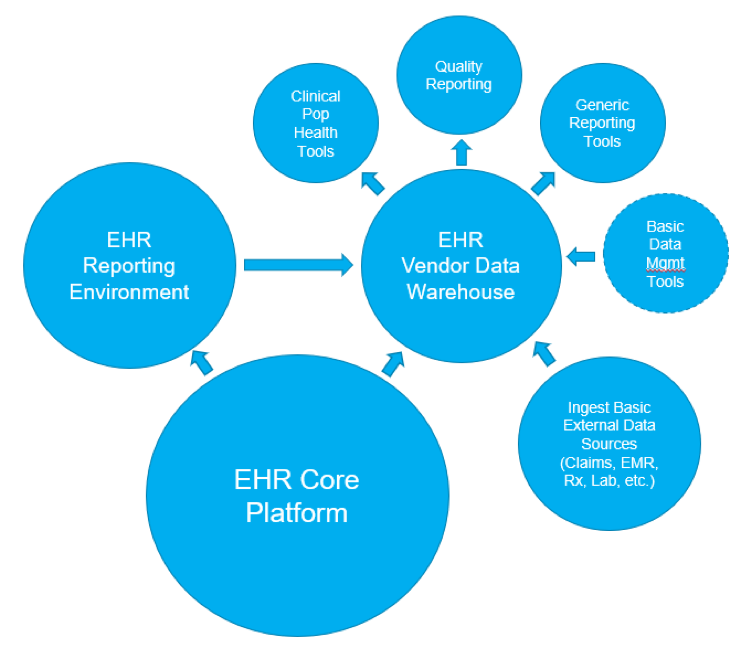

The reality is that EHR vendor analytics offerings predominantly focus on supporting PHM use cases—with their core analytics offerings centering around the data stored within the EHR itself. The typical EHR vendor approach to an enterprise data warehouse (EDW) largely supports EHR data, aggregated with available claims data and several other data sources, forming the basis of their analytics capabilities. When compared to the strategic and transformative imperatives listed above (e.g., growth, innovation, and digital), the EHR vendor approach to enterprise analytics doesn’t adequately meet an organization’s short-term needs and poses serious challenges to mid-range and long-term needs.

Health systems that rely on their EHR vendors to meet enterprise analytic requirements are asking the system to perform beyond its capabilities—similarly to expecting a primary care physician to specialize in orthopedic, neuro, and general surgery, and cardiac procedures. For enterprise analytics, an open-standards, cloud-based enterprise data platform with best-in-class analytic solutions is paramount for success.

IT and analytic leaders are feeling challenges and pressures (Figure 1) regarding their EHR vendors’ analytics offerings, typically coupled with homegrown solutions and myriad analytics point solutions. While EHR vendors may promise broader analytic capabilities, health system data analysts spend most of their time cleansing and preparing data, leaving little time to produce meaningful analytics.

So where do health systems stand that have invested heavily in their EHRs but need expanded healthcare interoperability and advanced, enterprise-level analytics capabilities? They need a vendor-agnostic analytics platform that can extend EHR capabilities, allowing health systems to maximize their EHR’s potential.

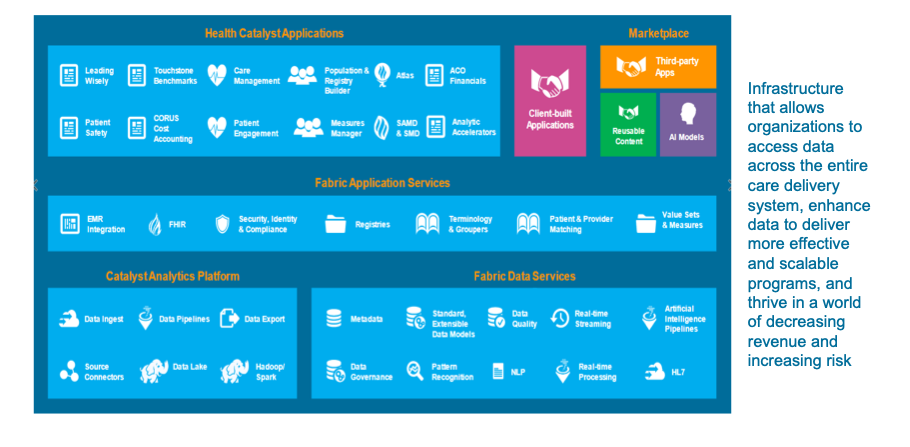

Such a platform (e.g., the Health Catalyst® Data Operating System [DOS™]), Figure 2, works with existing EHRs; it can quickly and flexibly ingest data from hundreds of other industry data sources to populate workflows with critical point-of-decision insights, significantly increasing the value of the EHR to care providers.

Six key elements differentiate an enterprise data platform approach from an EHR vendor’s analytic capabilities:

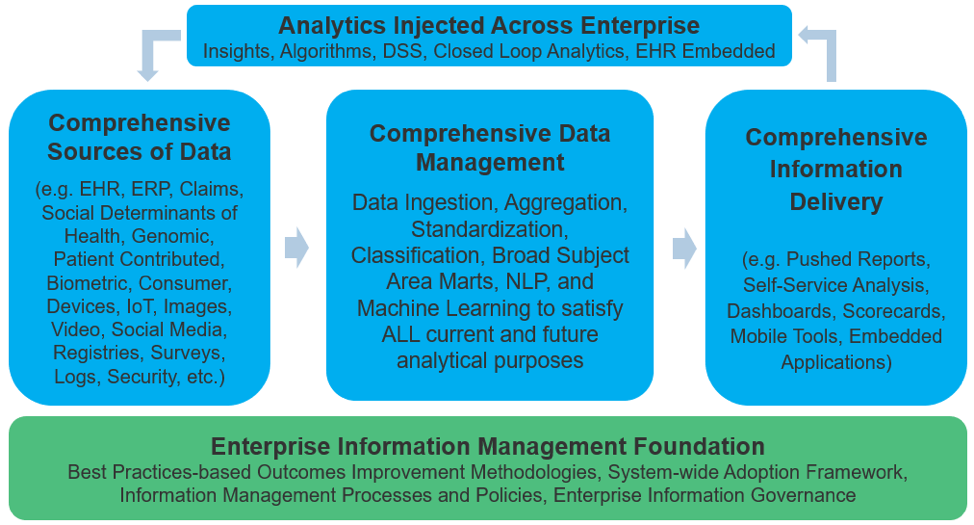

As depicted in Figure 3, an enterprise data platform must support the broad data management and analytic use cases spanning all clinical, operational, and financial functions, including:

An EHR vendor’s core product is the EHR itself (Figure 4), not its offerings. It builds its analytics infrastructures and tools, out of necessity, to support its 25-plus-year-old data structures and core EHR infrastructure. This places numerous and onerous restrictions on these analytics infrastructures, both in the short-term and longer-term.

A key challenge for organizations is that data analysts spend much of their time writing custom scripts to map sources of data to database tables, and even more code to query those tables to answer every analytics question. The heavy investment of analyst time (typically about 80 percent) means ROI rarely, if ever, meets stakeholder expectations.

To keep pace with the breadth of an organization’s enterprise analytics needs, an enterprise data platform must be able to flexibly and rapidly ingest all types of data across myriad data sources. The platform should automate and standardize data mapping and modeling for all data sources and data types. To further bolster ROI and productivity, the platform should automatically map sources to marts and capture metadata for every field in a comprehensive repository, as well as organize columns and data loads during nightly ETL processes.

Primary EHR vendors analytics infrastructures don’t provide customer-accessible source data marts. This prevents data scientists, researchers, and advanced analysts from accessing the level of granular, detailed, non-normalized data they need to build advanced analytics. An enterprise analytics program feels significant constraint, and organizations must maintain a separate data warehouse infrastructure for accessing raw source data.

Maintaining a separate EDW environment from the EHR vendor’s EDW infrastructure significantly increases total cost of ownership and complexity and decreases data scientists’ and analysts’ flexibility and efficiency. Over time, organizations view the EHR vendor’s EDW as yet another point analytics solution that addresses only a subset of the organizations’ overall analytics requirements.

An enterprise data platform must include an integrated data lake environment that aggregates all source data, preserves raw data granularity, is open and scalable, and allows for direct access by data scientists and advanced analysts using open tools. This must be a fully integrated environment that also allows advanced users to simultaneously access fully curated, shared data, along with any needed domain-specific data within the platform’s subject area marts.

The healthcare industry has been torn on data model approaches to support analytics needs. With arguable pros and cons to each approach. it’s helpful to have a better understanding of each:

A balanced data model approach is efficient and reusable, yet highly flexible to adapt to new types and volumes of data. An enterprise data platform must be able to rapidly deploy analytics solutions (e.g., reports, dashboards, scorecards, etc.) based on frequently used data types while providing full flexibility to rapidly ingest new data sources and data types that can be manually curated into subject area marts as needed. This hybrid approach to a data model provides two key capabilities:

The primary EHR vendors only offer a handful of analytics applications. These predominantly focus around basic population health management functions, such as patient registries and care management tools. In addition, EHR vendors only offer a narrow selection of third-party analytics and reporting tools that support their data infrastructure. Again, client organizations are forced to develop (or hire their EHR vendor’s professional services) to build the bulk of the tools and solutions they need to provide analytics.

An enterprise data platform should provide the bulk of the analytics tools and solutions an organization needs to address many enterprisewide and domain-specific needs. Healthcare-specific accelerators should be included in the platform that, out of the box, meet more than 60 percent of healthcare domain-specific analytics (e.g., sepsis, heart failure, diabetes, readmissions, CLABSI, CAUTI, etc.) In addition, the platform should provide self-service tools for users across the organization to build patient populations and registries, track measures, and visually drill into domain specific data sets.

A new breed of enterprise analytics use cases requires real-time data ingestion to enable immediate decision support. EHR vendors have built their EDWs using a legacy approach that follows the traditional ETL model of batch loading data from source systems via custom ETL scripts. EDWs ingest data afterhours, so data is typically 12 to 24 hours old before it’s available to analytics consumers. Worse yet, some vendors require that data generated within the EHR must first be batch loaded into a data subset and subsequently loaded into the EDW, further delaying load times to potentially 30-plus hours.

A modern enterprise data platform must still be able to support traditional data batch load processes; however, it must also support the real-time ingestion of data from required source systems or external tools to support real-time decision making at the front line—whether within an EHR workflow, at the front office in a revenue cycle workflow, or within the contact center integrated in a customer relationship management (CRM) workflow.

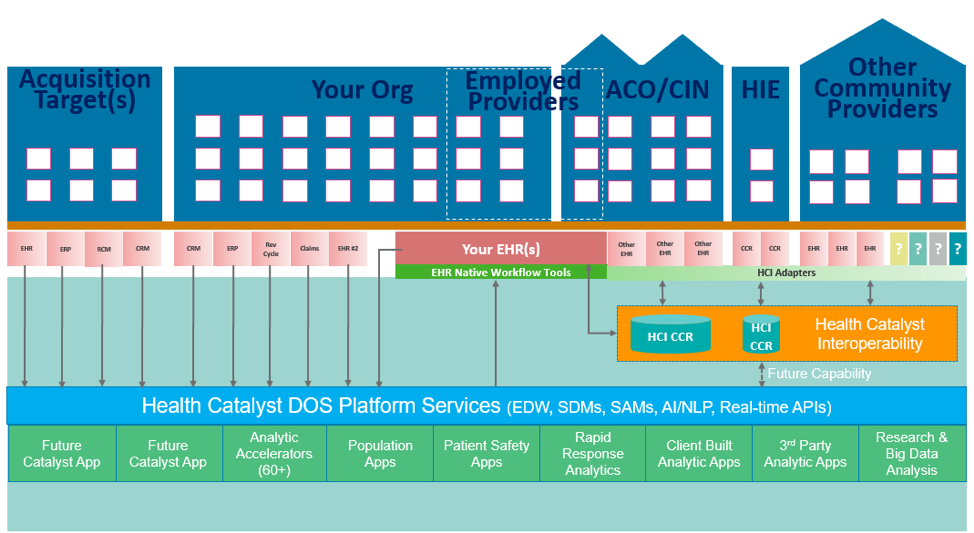

In the big picture of an EHR vendor system and an enterprise analytics platform (e.g., DOS, Figure 5), the two systems work together to maximize each entity’s capabilities and fully leverage patient data.

The EHR vendor brings key capabilities to enterprise analytics:

The enterprise analytics platform builds on EHR competencies and adds critical data and analytics capabilities:

Organizations should pursue a data and analytics strategy that will fully support the broad needs of the enterprise, both for today and the future. Building that strategy on an EHR vendor analytics infrastructure and tools will have many shortcomings and require a mix of custom and point-solution analytics to fill the gaps, further perpetuating multiple data stores and disjointed solutions.

In a better analytics strategy approach, health systems partner with a vendor that provides a robust, modern, enterprise data management and analytics platform. In addition, the right partner has decades of successful healthcare analytics and outcomes improvement implementation experience, ensuring an enterprise analytics program gets the right start and will sustain itself for the long term.

Would you like to learn more about this topic? Here are some articles we suggest: