Health system may have some compelling reasons for choosing to build a data platform versus partner with a healthcare analytics vendor on a commercial solution. However, while organizations may think they’re saving money, gaining control and security, and more by opting for a homegrown approach, they’ll more than likely encounter challenges, hidden costs, and limitations. In comparison to a commercial-grade, healthcare-specific platform from a vendor, build-your-own solutions fall short when it comes to domain-specific content, technical expertise, total cost of ownership, and more. Organizations that partner on a vended platform vastly improve their chances of optimizing and scaling their analytic investment over time and achieving measurable improvement.

Some healthcare organizations choose to build their own data platforms for several compelling reasons. For example, they believe they’ll have greater control over their data security and platform architecture than with vendor solutions and can more effectively control costs. Health systems also may think they know their data and operations best and can therefore leverage their existing data and analytics investment with an add-on from a vendor.

While these considerations are valid, build-your-own (BYO) solutions tend to carry common challenges that lead to significant analytic productivity challenges now and in the future. The alternative to BYO—a commercial-grade, healthcare-specific platform from a vendor—supplies and handles the content (e.g., registry definitions, terminology, electronic clinical quality measures, metadata, etc.), expertise, total cost of ownership, and more that optimizes an organization’s analytic investment and delivers measurable improvement.

Healthcare organizations that build their own data and analytics platforms most often build these solutions on cloud-based, open database management systems (e.g., IBM, Oracle, Epic, homegrown Microsoft SQL server, and more). These technology vendors, however, are only starting points—health systems need many more services to develop agile, future-ump toproof data and analytics platforms.

Try as they may, traditional (non-healthcare specific) technology vendors (e.g., Oracle, Microsoft, IBM) have proven time and again that they can’t build vertical solutions that address specific domain needs (in this case, healthcare). Some vendors try to buy their way into verticals through mergers and acquisitions (M&A) but often fail to properly integrate the acquired technology, resulting in siloed solutions no one can use.

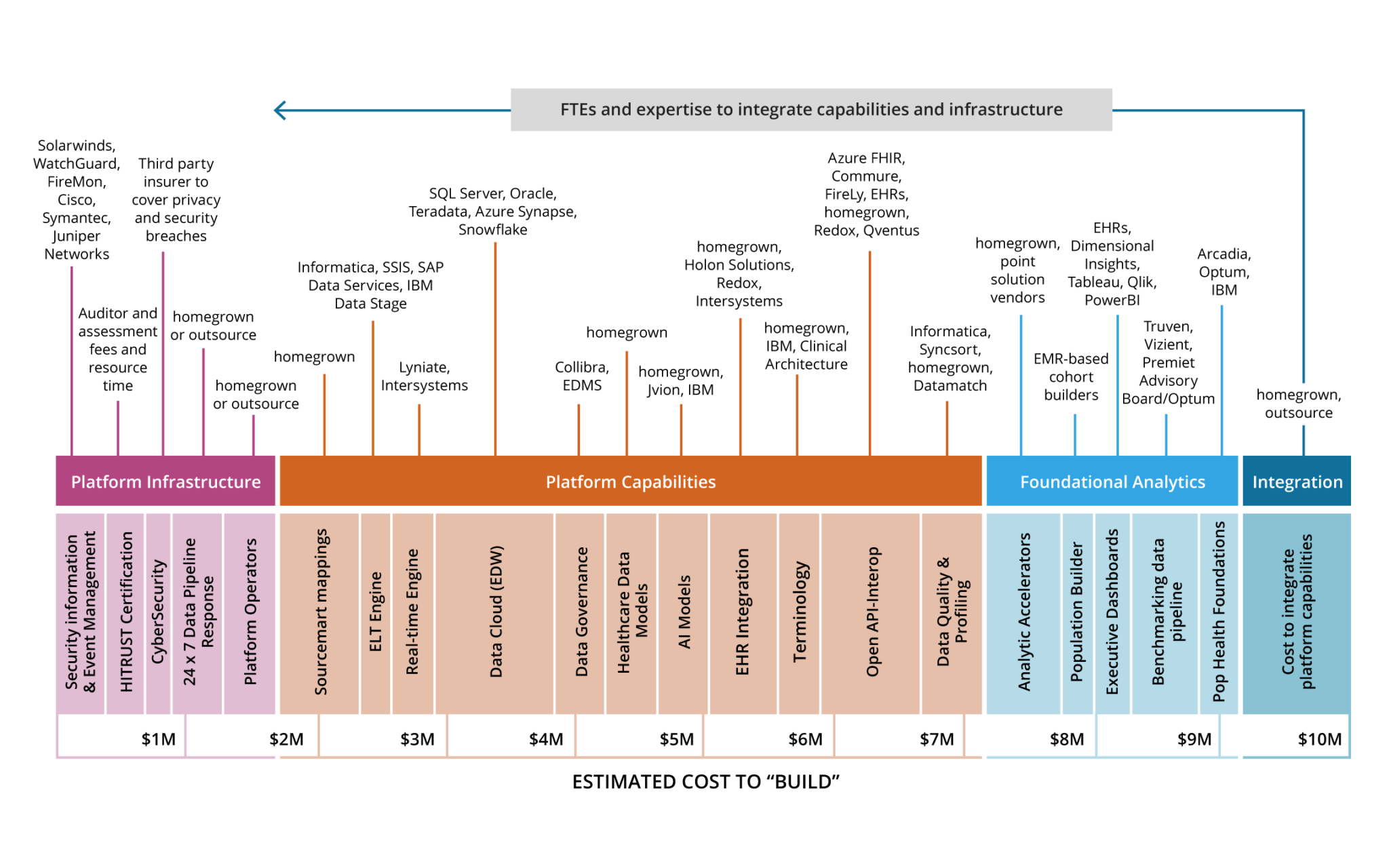

In a BYO scenario, acquiring the requisite services for a capable platform requires health systems to buy licensing for third-party databases. As Figure 1 shows, organizations choosing a BYO route have to contract with a lot of third-party vendors and take on a licensing/procurement function, including managing renewals, capital expenditure, operating expense implications, and more.

A seamless alternative to the BYO approach, a commercial platform (such as Health Catalyst’s), supplies and orchestrates the above needed services, ultimately delivering a positive ROI compared with the expense of individual contracting. The vendor partner absorbs much of the development expenses, such as terminology (Amercian Medical Association CPT®) or Johns Hopkins groupers (ACG® system), allowing the organization to focus on its business, rather than putting the pieces together and navigating licensing to create an integrated, scalable platform.

Even health systems that use cloud services (e.g., Microsoft Azure) to build data and analytics platforms won’t end up with fully featured solutions, requiring them to license some capabilities (such as platform capabilities and foundational analytics). In this way, the BYO platform is like a do-it-yourself (DIY) home remodel versus renovating with a contractor. The DIY builder pieces together materials and services (often at extra expense), whereas a contractor has access to all needed elements and the skillsets (e.g., architect and interior designer) to ensure the home fits together.

Constant change in the healthcare ecosystem has for some time driven the need for more healthcare data. But, as of 2020, COVID-19 has added unprecedented urgency to healthcare digitization. This continuous evolution not only requires response but also development for orchestration. In many ways, orchestration is a down payment for tomorrow while also solving today’s problems.

Many organizations aren’t building for long-term reliability but only look to solve today’s problems. In doing so, these health systems are amassing a lot of technical debt. With a vendor, that partner (the vendor) takes on this technical debt, future proofing the organization’s data and analytics and allowing health systems to focus on delivering analytic value, including improving health outcomes.

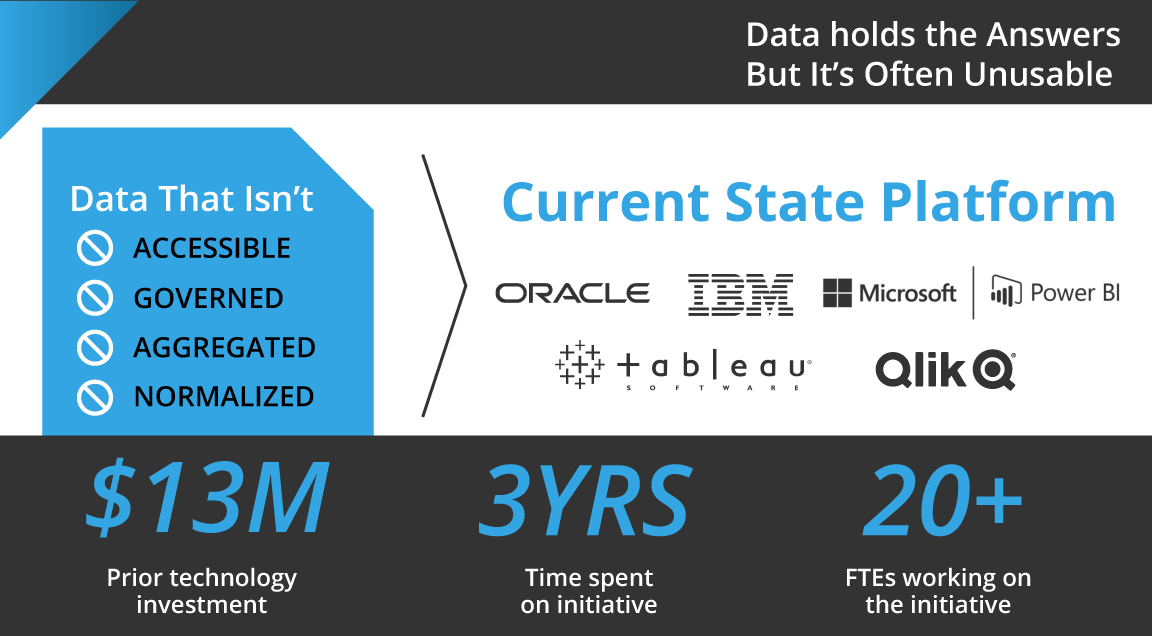

Organizations need—now more than ever—reliable, scalable, data and analytics infrastructures that can keep up with a growing demand for accessible data and actionable insights. Too often, however, platforms don’t deliver usable data despite significant investment, time, and workforce resources (Figure 2).

With such a tall order in analytics productivity, health systems building their own platforms must beware of the following formidable challenges surrounding BYO data platforms:

Many BYO platforms struggle to handle domain-specific healthcare data (including CPT codes, John Hopkins ACG, LOINC, SNOMED, benchmarking data, and more). The horizontal platforms of many BYO data solutions tend to serve multiple industries and therefore lack healthcare knowledge and the appropriate supporting technology (i.e., they’re not fit for purpose). And even commercial industry-agnostic solutions that start with a horizontal platform with great technology can run into trouble when it comes to solving healthcare problems and seeing a solid ROI. This is where a “pure-play” (i.e., healthcare-specific vendor) comes in—a platform, such as Health Catalyst, that specializes only in healthcare, whereas horizontal solutions may take on manufacturing, banking, insurance, and more.

Furthermore, making sense of the data asset is difficult without reusable healthcare data (e.g., terminology, curated data models). Health systems choosing BYO solutions struggle to match the level of technological product knowledge or service expertise available with vendor offerings. Only a pure-play healthcare vendor has the experience from building analytics solutions for multiple organizations to acquire the technical product and data knowledge necessary to run repeatable healthcare data and analytics.

Healthcare leaders may look at BYO solutions without thinking about the technology debt the organization will incur when one tool ages out and another comes on the scene—such as moving from a SQL server (small data) to data lake technology (big data). When these organizations want to leverage cutting-edge technology (e.g., R, Python, Snowflake, and Databricks), they often aren’t thinking about the integration cost (also known as orchestration). However, these expenses stack up over time. For example, if an organization must change servers, such as a seemingly simple move from SQL 2012/2016 to SQL 2019, they likely won’t have invested in the skillset to make this happen without significant disruption.

Meanwhile, too many health systems don’t invest in a development team’s technical skills and growth to keep pace with evolving technology. Many healthcare organizations focus on analytic skillsets rather than nurturing development and engineering teams. As a result, these systems must contract out for ongoing integration of third-party components, whereas a vendor platform takes on these development and engineering risks (and costs) for its partners.

Some health systems contract out for technical skills or hiring new talent. However, with today’s competitive technology hiring environment and challenges to retain top R&D talent, even organizations with the right skills on board risk losing team members to recruitment. Additionally, technology integration in BYO solutions can put new analytic work on hold while data and analytic teams focus on integrating technologies—a challenge that further incentivizes health systems to rely on vendors for technical skillsets versus developing their own. A pure-play vended solution partner assumes all the “skilling up” and insulates the health system from this talent debt exposure.

Like underestimating ongoing integration costs, organizations taking a BYO approach tend to miscalculate what it takes to bring independent tools together and yield value—or orchestrate and govern their data. A robust platform will require an interoperability engine, vocabulary service, patient matching, visualization, data governance, data quality, artificial intelligence (AI), machine learning, natural language processing, performance monitoring, alerting, and security monitoring.

When health systems don’t invest in orchestration and governance up front with a commercial platform, they will continually accrue debt as they try to keep up with disparate vendor solution upgrades and the associated coordination.

For example, BYO users will have to constantly validate that each upgrade doesn’t impact downstream logic, manage contract renewal for each add-on, and navigate changes like the impacts on technology when one third-party vendor acquires another. Additionally, BYO platforms are less capable, due to narrow experience, than vendor offerings to scale and flex with changing ecosystems in the event of health system M&A.

While AI can be a powerful tool, using it the wrong way leads to wrong prediction, poor financial outcomes, and possibly even patient harm. Computing AI by itself and not orchestrating into existing workflows and business intelligence tools is symptomatic of the BYO approach. A modern vendor platform embeds AI (supported by frameworks such as Healthcare.AIÔ), giving users an augmented visualization (i.e., an augmented line chart) of critical data. This enhanced view helps decision makers consistently and accurately interpret the data, regardless of their statistical or analytics expertise.

Even given the above challenges of BYO platforms, some healthcare organizations believe they have greater control of their data with their own versus a full vendor solution. Fortunately, forward-looking vended platforms, such as the Health Catalyst Data and Analytics Platform, can coexist with large EHRs, allowing the health system to control its data while the vendor runs the orchestration via a hosted cloud environment.

Expert vendor capabilities add the following three major benefits to the data and analytics platform:

With a shorter analytics lifecycle, the right vendor platform enables the following must-have competencies:

Strengthening analytics accuracy and trust helps organizations get the right answer the first time and avoid the cost of misleading or divergent insights. Three components lead to more accurate, trustworthy data:

A future-proof analytics engine keeps analytics cycles flowing while adapting to macro-level changes in technology and healthcare. This forward-looking engine continuously integrates new technologies (e.g., FHIR, cloud hosting, process patterns) and provides an adaptable data model that supports a limitless number of enterprisewide analytics use cases.

With greater access to cloud-based management systems and vendor add-ons, organizations can build on their own solution—but may want to think twice about the associated challenges, limitations, and costs. By partnering with an expert vendor, such as the Health Catalyst offering, health systems gain a breadth of expertise and support that enables systematic and repeatable improvements to quality, revenue, cost, and patient experience. In this way, organizations partner with a vendor can confidently scale with analytics productivity over the long term.

Would you like to learn more about this topic? Here are some articles we suggest:

PowerPoint Slides

Would you like to use or share these concepts? Download the presentation highlighting the key main points.

Click Here to Download the Slides